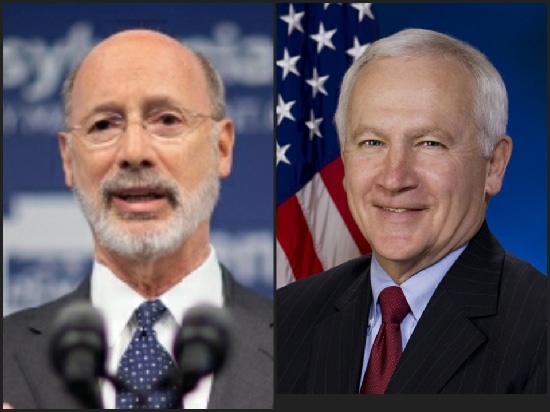

After Pennsylvania Gov. Tom Wolf unveiled his proposed $40.2 billion 2021-22 General Fund Budget last week, state Sen. Gene Yaw (R – Bradford) immediately pointed to Wolf’s proposed massive increase in state spending, a substantial personal income tax rate hike, imposition of Marcellus Shale extraction tax, and elimination of funding for broadband expansion, as well as vital agricultural and health programs and services — all in the midst of the financial crisis, unemployment, lost jobs and business closings caused by the Covid-19 pandemic.

Yaw wants constituents to know Wolf’s proposed FY 2021-22 budget includes a $3.1 billion (8.2 percent) increase in state spending from the current fiscal year. Plus, Wolf wants to increase the state personal income tax (PIT) rate from 3.07 percent to 4.49 percent (a 46.3 percent hike) as of July 1 to raise $3 billion annually.

“About one-third of all Pennsylvanians, would see their state tax burden increase under the Governor’s proposed PIT rate hike,” Yaw noted.

Upwards of one million Pennsylvania small businesses will have their tax rates increased by 46.3 percent under Wolf’s proposal, since these pass-through businesses (i.e. S corporations, partnerships, etc.) pay business taxes at the PIT rate.

This proposed PIT rate increase coupled with Wolf’s ongoing COVID-19 restrictions and his proposed minimum wage hike would be devastating for many family operations that are already struggling to stay financially solvent.

Wolf is again making his annual push for a Marcellus Shale extraction tax. Pennsylvania saw a $50 million reduction in its impact fee revenue, according to the latest Independent Fiscal Office report.

Wolf is also proposing a $168 million plan to augment funding to the State Police by charging all municipalities for police services regardless of municipal coverage.

While the governor is calling for a major spending increase in several budgetary line items, he is also planning to eliminate $5 million in state funding for broadband expansion, even though the funding is mandated by Act 132 of 2020 (Senate Bill 835), as well as millions of dollars for agricultural programs and health care services.